Article Advice

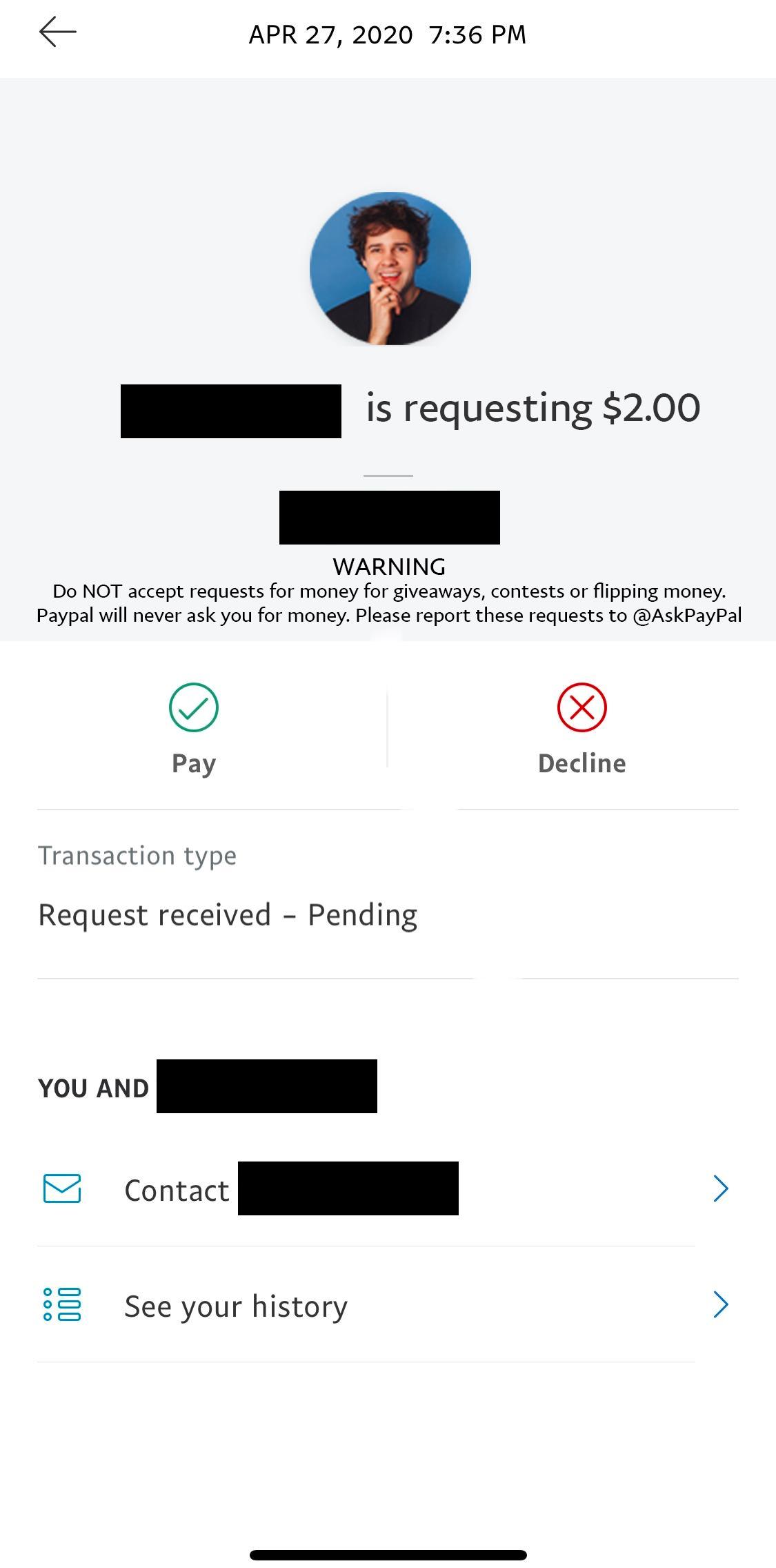

When it comes to signature loans, there are lots of legitimate lenders and you can functions readily available. Sadly, there are also fraudsters seeking to make use of customers. When you look at the 2022, fraudsters stole almost $8.8 million regarding Us americans, according to Federal Change Payment (FTC). To protect on your own out-of one upcoming stresses, it is important to be on the lookout to own common symptoms of consumer loan cons.

Unsecured loan cons can be challenging to identify because there are various kinds of frauds that target people. Tend to, these scams aim to availableness valuable personal data in regards to you instance their Social Shelter amount or mastercard matter installment loans online in New York. Cons can also become seeking to availability your bank accounts, charging air-higher interest levels and you will costs or causing you to pay money for a good personal bank loan you will never get access to.

1. The lender requests for charge initial

A reputable financial wouldn’t request you to spend an initial percentage to view personal bank loan money or even remark consumer loan papers. In the event that a lender does request fee one which just availability your loan financing, this really is almost always a sign of a scam.

This is the way signature loans functions: When you pay-off a consumer loan, you will do therefore in the way of monthly obligations. You’ll make constant improvements toward paying the primary balance additionally the attract fees.

dos. The lending company pledges you might be accepted before you apply

An advertisement of guaranteed approval to possess a personal bank loan is yet another signal one a lender can be seeking to take advantage of your. Essentially, personal loan loan providers provides a handful of standards one consumers you need to fulfill to get approval to possess a consumer loan. Your credit history, income and other things need certainly to fulfill a specific level of criteria having a loan provider feeling safe issuing your a great consumer loan.

You’ll find personal loan facts in the industry which make it possible for consumers which have lower credit ratings to get a personal financing, but even those people financing have requirements that have to be satisfied. A guarantee regarding protected mortgage recognition can often be a sign of a good subprime financing or an entire scam.

step 3. The financial institution intends to obvious the debt

When the a package audio too good to be true, it is commonly. A familiar illustration of an unsecured loan fraud concerns guaranteeing in order to clear the debt. This is accomplished by the stating to get financial obligation payments in order so you can pay a current source of loans.

Keep away from these types of also offers and alternatively work yourself along with your bank to see what possibilities you really have for making reduced improvements toward financial obligation cost.

4. The lender actually joined on your own county

In the event that a loan provider is not joined on your own state, they can not legally offer you a personal loan. They should check in in the usa where it efforts the providers. In advance of agreeing to almost any financing has the benefit of, double-check that the financial institution are entered throughout the state you reside.

This can be done because of the contacting your state attorney general otherwise financial or economic features regulator. You can find out ideas on how to get hold of your specific state’s bank regulator here.

5. The lender calls you which have a deal

An established unsecured loan financial basically will not market their characteristics because of the cold-calling consumers and you may leading them to financing render at that moment. While a lender is located at over to you first, this will be a sign of good scam artist trying acquire the means to access your very own financial pointers.

It is advisable behavior to not address loan providers or financial institutions who leave you a deal by the phone, door-to-doorway solicitation otherwise via post. That it is unlawful for a financial loan issuer to offer that loan over the phone.

What are genuine personal bank loan also provides

A consumer loan was an extremely of use monetary tool, very do not let prospective scams scare you removed from credit currency for the breathtaking cooking area redesign. When it comes time to try to get an unsecured loan, these are specific actions you can take to track down a reputable loan bank.

- Show the lender was joined on your county: You can speak to your condition attorneys standard or the state’s banking otherwise monetary properties regulator to confirm in the event the a loan provider is actually entered in your state. Think of – they cannot lawfully topic that loan when they commonly joined in order to do business from the county you reside.

- Check out the lender’s on the web evaluations: When looking for the best place to rating a personal bank loan, viewpoints from other borrowers can help you get a thought if a loan provider are reliable or perhaps not. Here are a few Better business bureau (BBB) reports and other certified ratings and read evaluations online to know much more about customer event.

- Take a look at the the new lender’s on the web exposure: Do the financial institution keeps a web site that is accessible? Really does one to web site without difficulty provide the information you need while making a decision regarding a financing product? If for example the bank has no a professional website which have right contact home elevators they, that is an indicator to walk aside.

How to handle it if you feel you will be are ripped off

If you suspect you had been employed in a personal loan scam or one to an excellent scammer attempted to target your, you can find activities to do so you can report the non-public loan fraud.

- Contact one people inside: First some thing basic, for people who provided currency towards scammer easily contact any organizations your worked with to really make the commission just like your bank otherwise credit card team. As much as possible, terminate one costs and ask for let securing your accounts.

- Document an authorities statement: Be sure to make contact with the authorities and you can document research. You should demand a copy of cops are accountable to continue hands getting proof of the newest experience.

- Keep an eye on your own borrowing from the bank: In the event your scam artist enjoys accessibility pinpointing factual statements about you one capable used to open borrowing from the bank account on your own label, this will seriously destroy your credit rating. Create credit monitoring otherwise believe freezing the borrowing from the bank so you’re able to prevent fake choices.

- Would research to your FTC: To assist prevent the scam artist from injuring almost every other customers on coming, file a summary of one guessed personal bank loan scams to the FTC.