To address these issues, HOLC ordered and you may refinanced such loans into the more affordable amortized mortgages you to directly resemble the present mortgage points

The applying next rented regional a property designers, appraisers, and you may lenders to understand the amount of risk to possess financial delinquencies and you will non-payments of the home-based neighborhood. Yet not, this type of regional-height actors consistently managed Black and you can immigrant owners because the a danger so you’re able to home values and you may mortgage quality, and often rated people areas due to the fact red-colored, definition harmful. 21 HOLC used such charts whenever maintenance this new refinanced mortgages and you may starting guidelines to assist struggling home owners weather the newest drama. 22

Likewise, the new FHA, and that given home loan insurance policies to attenuate lenders’ economic risks and you can encourage their contribution throughout the battling market, factored competition to the the underwriting, 23 declaring within its 1938 Underwriting Guide that the infiltration out-of inharmonious racial communities . commonly decrease the levels of homes opinions and stop the brand new desirability away from home-based elements. 24 The loan community used this new FHA’s lead and often refused to make finance in the Black and you may immigrant teams. twenty-five This behavior, also known as redlining, avoided consumers within the predominantly Black communities regarding acquiring mortgage loans and getting home owners.

Even if boffins always argument if or not HOLC or other organizations explicitly utilized the maps to limitation financing so you’re able to individuals regarding color and you will about what extent these were afterwards used by the newest FHA, very scholars agree totally that brand new maps played an associate when you look at the perpetuating racial prejudice and segregation in the federal houses guidelines in addition to field. twenty six About resulting decades, individuals of color was in fact disproportionately less likely to individual a good house and build wide range, now of many Black and you may Latina individuals however face barriers whenever trying to mortgage loans and are also likely to be than simply Light consumers to use option money. twenty seven

On the other hand, the applying shared the latest strategy at the rear of the maps with other government organizations, change relationships, and lenders which used an identical biased feedback on the company and you may regulatory loan places Mountain Brook strategies

Then, regulations during the regional peak has and continue to keep individuals off obtaining casing in common elements, whether or not they’re able to safer money. Such, exclusionary zoning prohibits certain types of homes, including multifamily gadgets or shorter plenty, in a few areas, and that limits property choices. A powerful body out-of studies have found that such zoning, subsequently, pushes right up home prices, effortlessly barring down-money family members, who’re prone to feel folks of colour, out-of to get in those communities. twenty eight

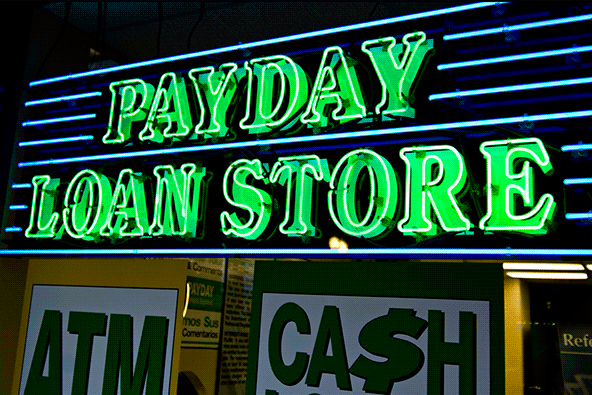

Particularly, in the early sixties, Common Developers and you may F&F Money from inside the Chicago offered property in order to Black consumers and you may provided money in the way of homes contracts. Nevertheless the agreements tended to ability excessive profit pricing, 29 significantly more than-market interest levels, and you can weak individual defenses that allowed new sellers to add risky clauses built to bring about defaults, and therefore, therefore, will brought about buyers to get rid of their homes plus the money they had spent. In response, thousands of Black homeowners designed the new Chi town Buyers League, and therefore prepared grassroots strategies against dangerous land agreements and you may renegotiated over 200 preparations toward a couple of enterprises. 31

In the 1968, Congress passed the new Fair Homes Work, so it is illegal so you’re able to discriminate home based conversion, rentals, or financing based on race, color, national source, faith, sex, familial condition, otherwise disability. 29 Even though this rules started initially to open mortgage accessibility for consumers regarding colour, credit methods was indeed sluggish to alter and you will, coupled with ework to own alternative financial support, went on in order to remind suppliers to provide alternative agreements when you look at the Black communities. By way of example, from the later seventies and you will very early mid-eighties since financial rates of interest leaped, the fresh Federal Reserve Panel reported a keen uptick from inside the alternative preparations, primarily land agreements. thirty two Recently, boffins documented a rise in house deals off 2008 to 2013 inside the four southeastern towns and cities-Atlanta; Birmingham, Alabama; Jackson, Mississippi; and you will Jacksonville, Florida-when home loan credit fasten. 33 And you may evidence indicates that residential property agreements are more common into the teams away from colour and you can components with low levels regarding financial financing. 34